How to Get a Home Equity Loan

03/11/2024

By: Lindsey Fredericks

With lower interest rates than unsecured loans (like personal loans and credit cards) and flexible term lengths and payment options, home equity loans are popular financing choices for a variety of needs. However, while it's usually quite easy to apply for this kind of loan, there are a number of considerations to keep in mind first.

In this post, we'll explain the basics of home equity loans, compare different home equity loan options, and lay out the qualification and application process, so you can make the best choice for your lending requirements.

What is a Home Equity Loan?

Before we explain what a home equity loan is, it’s important to define “home equity.” Your home equity is the value of your home minus any loans you have against it. For most borrowers, this includes the balance of your mortgage, but it could also include home equity lines of credit, or other home equity loans. For example, if your home is valued at $300,000 and your mortgage loan balance is $200,000, your home equity is $100,000 ($300,000 - $200,000 = $100,000).

A home equity loan is a secured lending product that uses the equity in your home as collateral, just like your initial mortgage used the full value of your home as collateral. Most home equity loan amounts are capped at 80% of your home’s equity.

Home Equity Loans Vs. Home Equity Lines of Credit

Home equity loans are different from home equity lines of credit (HELOCs). With a home equity loan, you’ll receive a lump sum payment at closing. With a home equity line of credit, you’ll receive access to a revolving line of credit (similar to a credit card) with a borrowing limit equity to a portion of your home equity.

Home equity loans may be more useful to pay for large, one-time expenses, while HELOCs are often used to pay for ongoing expenses. To learn more about the differences between these lending products, check out our informative posts, Home Equity Loan vs. Home Equity Line of Credit and Everything You Need to Know about HELOCs.

What can you use home equity loans for?

Both home equity loans and home equity lines of credit can be used for whatever you want—unlike a mortgage, you don’t have to use them on home-related costs. However, many borrowers choose these equity-based loan products for home renovations, repairs, additions, and other uses that add value to their home. The IRS encourages using them for these purposes, even offering tax deductions on their interest “if home equity loans or lines of credit secured by your main home or second home are used to buy, build, or substantially improve the residence.”

How does a Home Equity Loan work?

A home equity loan is a lot like a mortgage. In fact, they’re often casually called “second mortgages”. The application process is similar to the mortgage application process (more on this later), you’ll have a loan closing, and you’ll receive a check in your approved amount.

Term Lengths

The length of your home equity loan depends on a variety of factors including the total loan amount, the interest rate, and how much you are able to pay back each month. Because of this, loans can range anywhere from 1 year (for smaller loans) to 15 years for larger ones.

Monthly Payments

Most home equity loans have fixed interest rates that are locked in at closing. This also means that your monthly payment will remain consistent over the life of your loan. Unlike a mortgage, your monthly payment will only include principal and interest—no real estate taxes, private mortgage insurance, homeowners’ insurance, or other fees.

Home equity lines of credit, by contrast, have an entirely different repayment structure. For the first five years or so (called the draw period), you’ll only be required to make interest-only payments on the funds you’ve used. Once you reach the end of your draw period, you'll have to make repayments based on your principal and remaining interest. Most HELOCs have variable interest rates, which means that they fluctuate based on the changes in the market.

What are the eligibility requirements for a Home Equity Loan?

One obvious eligibility requirement for home equity loans is that you must own a home. Beyond that, other qualifications include having:

- At least 20% of equity in your home.

- A debt-to-income ratio of no more than 43% (with your new loan amount)—though this can vary by lender.

- Some lenders also require a credit score of at least 620.

If you’ve purchased your house in the last few years, you may be worried that you haven’t accumulated 20% equity in your home. However, keep in mind that your home equity isn’t determined by your home’s purchase price minus your home loan balance(s). If you’ve had your home for a year or more, chances are that its value has gone up. When reviewing your application, your lender will order a new appraisal on your home, giving them a better idea of its current value (and equity!). According to the Pennsylvania Association of Realtors, home sale prices in Pennsylvania were up 2.4% in January 2024 compared to January 2023, however they fell about 7.5% compared to December 2023.

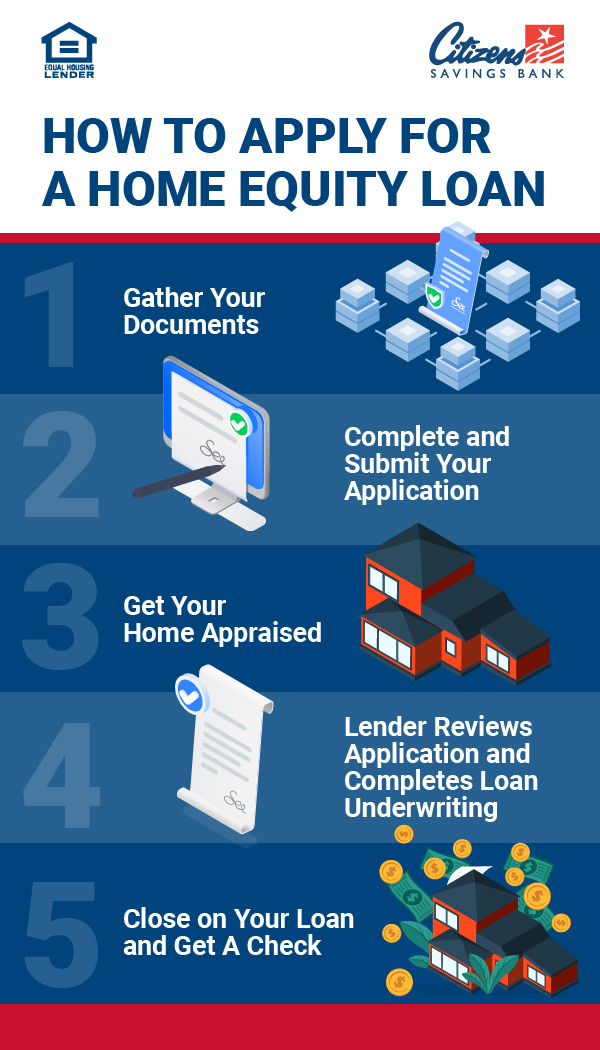

How to Apply for a Home Equity Loan

As we mentioned above, your application process will be similar to a mortgage application. Here are the basic steps for application.

- Gather your documents and info. You’ll need:

- Your name, address (and possibly previous addresses), and social security number

- A copy of a government-issued ID (driver’s license or passport)

- Employer information

- Pay stubs for the past month

- W-2 forms and federal tax filing statements for the past 2 years

- Bank and investment account statements for the previous two months

- Fill out and submit your application.

- When applying for a home equity loan at Citizen Savings Bank, you can easily apply online or in person with the help of a lender at your local bank branch.

- Home appraisal and loan underwriting.

- Your lender will likely arrange an appraisal to determine the current value of your home.

- Your lender will also run a credit check, verify income and assets, and complete other steps to ensure your qualification for the loan during this time. Don’t take out any new debts or close credit accounts to avoid running into issues with your approval.

- Close on your loan and get your check!

- At closing, you may be responsible for closing fees (usually 2-5% of the loan amount). However, some lenders may be able to roll them into the loan. *Citizens Savings Bank Offers a **No Fee promotion with a Home Equity or HELOC loan.

- How long does it take to get a home equity loan? Closing dates can vary from as little as two weeks to as long as six weeks from loan application, with many closings happening under a month.

- If you apply for a home equity loan through your current bank or mortgage lender, this process may take less time.

*Available on owner and non-owner occupied 1-4 family properties. Maximum loan to value ratio up to 80%. Subject to credit approval. Rates and fees are subject to change and can be modified or discontinued at any time without notice to you. Consult your tax advisor for further information regarding the deductibility of interest and charges. **No Fee promotion on owner-occupied home equity loans and home equity lines of credit (HELOC) except the cost of recording the mortgage. If loan or HELOC is paid off within 24 months of the origination date, the borrower will be responsible to reimburse Citizens Savings Bank for all the third-party origination fees paid.

Apply for a Home Equity Loan with Citizen Savings Bank Today

Ready to leverage your home’s equity? Whether you are looking to make improvements to your residence or are seeking a loan with an affordable interest rate, consider a home equity loan from Citizen Savings Bank to meet your financing needs.

Apply online for a home equity loan from Citizens Savings Bank, or work one-on-one with an experienced lender to learn more about our other borrowing options including HELOCs and Cash-Out Refinancing. With offices in Scranton, Mount Pocono, Taylor, Clarks Summit, and Honesdale, our dedicated lending team is just a phone call or quick visit away!

Citizens Savings Bank has multiple locations throughout Lackawanna, Wayne, and Monroe Counties. For branch locations and hours, visit our website. We also have a Customer Support Team ready to answer any questions you may have. Call us today at 1.800.692.6279 or email [email protected]. Member FDIC. Equal Housing Lender.